When a recession hits, it’s not just the stock market that makes headlines. Interest rates—those significant numbers that influence everything from mortgages to credit card debt—become a hot topic of discussion. But what happens to interest rates during an economic downturn? Do they shoot up, or do they drop? Understanding the relationship between recessions and interest rates can help you navigate financial decisions more confidently. Let’s break it down.

What Are Interest Rates?

Interest rates represent the cost of borrowing money or the return on savings, measured as a percentage of the amount borrowed or saved. They are a critical component of the financial system influencing economic behavior. Central banks set benchmark interest rates to guide the economy, using these rates to manage inflation, control the money supply, and stabilize the financial system. When rates are low, borrowing becomes cheaper, encouraging spending and investment, while higher rates can slow down economic activity.

The Role of Central Banks

Central banks are pivotal in managing interest rates to achieve economic stability. They monitor various economic indicators, including GDP growth, unemployment rates, and inflation, to inform their decisions. By adjusting interest rates, central banks aim to stimulate economic growth during downturns or cool off an overheating economy during periods of rapid expansion.

Understanding Recessions

A recession is characterized by a big decline in economic activity lasting more than a few months, typically measured by a decrease in GDP. During a recession, businesses may experience reduced sales, leading to layoffs and increased unemployment. Consumer confidence often wanes, resulting in decreased spending. These factors create a cycle of reduced economic activity, prompting central banks to intervene by adjusting interest rates to encourage growth and stabilize the economy.

Interest Rate Trends During Recessions

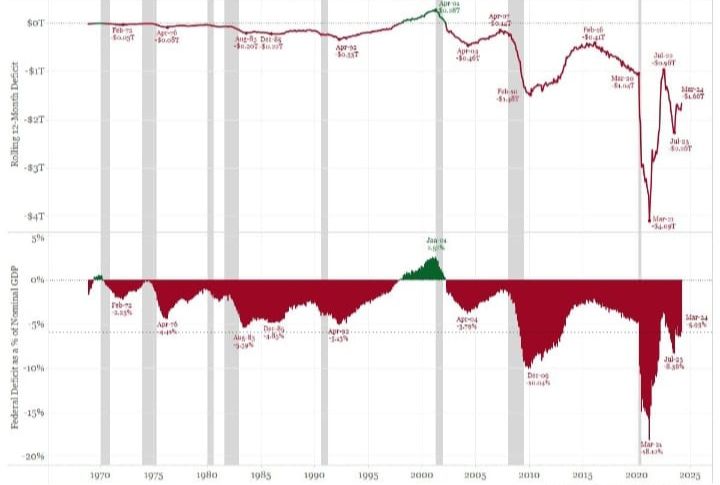

Historically, interest rates tend to decrease during recessions due to monetary policy measures taken by central banks to increase economic activity. Lowering interest rates reduces the cost of borrowing, making it more attractive for consumers and businesses to take out loans. This strategy encourages spending and investment, ultimately leading to economic recovery.

Historical Examples of Rate Cuts

The Great Recession from 2007 to 2009 serves as a prominent example of how central banks respond to economic downturns. During this period, the Federal Reserve slashed interest rates drastically in an effort to stimulate the economy. Similarly, during the COVID-19 pandemic in 2020, rates were cut to support the economy amid widespread lockdowns and uncertainty. These historical examples illustrate the common practice of lowering rates during recessions to promote recovery.

The Mechanism Behind Rate Reductions

Lowering interest rates during a recession serves multiple purposes. First, it aims to stimulate economic activity by reducing the cost of loans and encouraging consumers to borrow and spend. This increased demand can help boost business revenues and lead to job creation. Second, lower interest rates can help combat deflation, a situation in which prices fall due to reduced demand.

The Positive Impact of Lower Interest Rates

The reduction of interest rates during a recession can have multiple positive effects on the economy. Increased borrowing leads to higher consumer spending on big-ticket items such as homes and cars, which can stimulate various sectors of the economy. Moreover, businesses benefit from lower financing costs, allowing them to invest in expansion, hire new employees, and innovate.

Risks Associated with Low Interest Rates

While lower interest rates can push economic growth, they also come with risks. Longer periods of low rates can lead to inflation if demand outstrips supply, eroding purchasing power. Additionally, the availability of cheap credit can create asset bubbles, where prices for stocks or real estate become inflated beyond their intrinsic value. Central banks must carefully monitor these risks to avoid unintended consequences.

The Economic Cycle of Interest Rates

The relationship between interest rates and economic cycles is cyclical. During recessions, central banks typically cut rates to stimulate growth, while in times of economic recovery, they may raise rates to prevent overheating. This cycle is important for maintaining a balanced economy. Increased demand can lead to inflation as the economy improves, prompting central banks to gradually raise rates to keep inflation in check and ensure sustainable growth.

Key Takeaways

In summary, interest rates typically decrease during recessions as a strategy to stimulate activity. Central banks utilize rate adjustments as a primary tool for economic stabilization, aiming to encourage spending and investment during downturns. While lower rates can boost the economy, they also carry risks such as inflation and asset bubbles.