Money makes people do wild things, but these fraudsters took crazy to a new level. They built financial empires on pure fiction, convinced smart people to invest in nothing, and lived like kings while their victims lost everything. Their schemes were so outrageous that they sound like movie plots. The scary part? They actually happened and ruined thousands of lives. So let’s talk about the most jaw-dropping financial frauds ever.

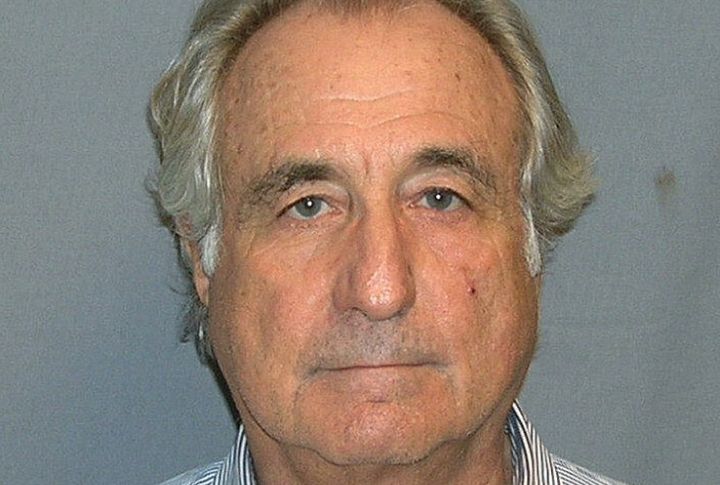

Bernie Madof

Bernie Madoff, once a well-known stockbroker and investment advisor, orchestrated the largest Ponzi scheme in history, taking $17.1 billion from investors while maintaining $64.8 billion in fake account balances. Even celebrities were caught in the web. And when the 2008 financial crisis hit, everything fell apart, leaving thousands shocked.

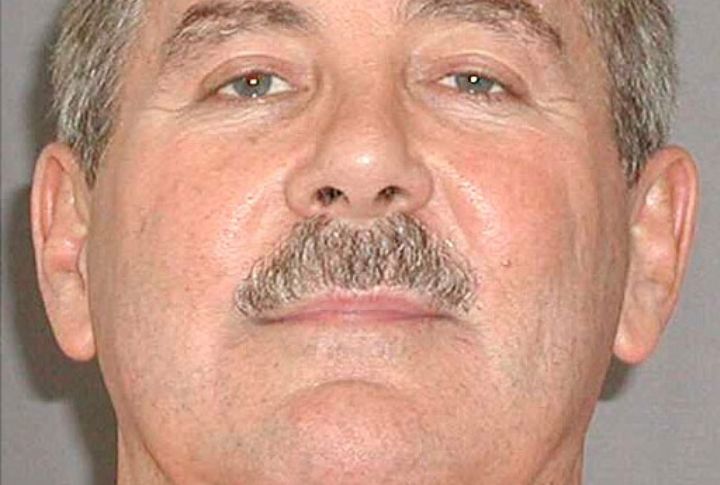

R. Allen Stanford

Just imagine being defrauded of $7 billion—R. Allen Stanford made that a reality. The former Stanford International Bank chairman sold phony certificates of deposit. After surviving a prison beating, he tried claiming amnesia to delay justice. But the court wasn’t fooled and slapped him with a jaw-dropping 110-year sentence.

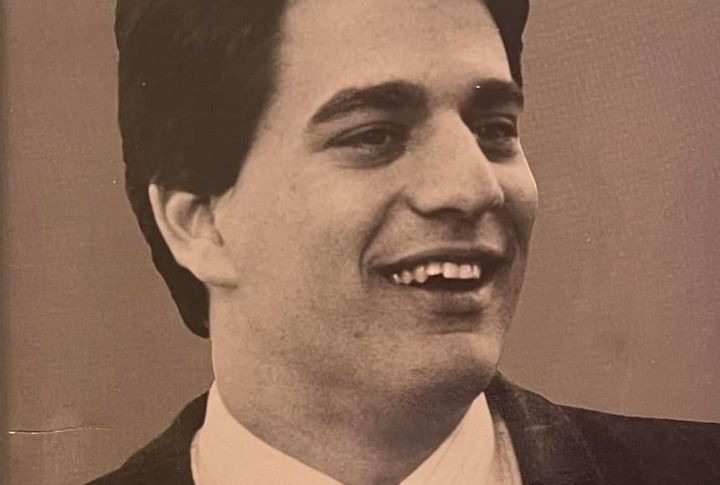

Scott Rothstein

This lawyer, named Scott Rothstein, used his law firm, known as “Rothstein Rosenfeldt Adler,” to run a huge scam. He tricked clients into giving him $1.2 billion by selling them fake legal deals. While they lost their money, he bought expensive cars and boats. However, the whole thing fell apart pretty quickly when clients asked for their money back.

OneCoin

Can you imagine losing $4.4 billion? That’s what happened with OneCoin. Promoted as a cryptocurrency but without any blockchain, it scammed contributors in 175 countries. Its founder, Ruja Ignatova—the “Cryptoqueen”—vanished in 2017. Today, she’s still on the FBI’s Most Wanted list, and her story inspires podcasts and documentaries.

Sergei Mavrodi

MMM, run by Sergei Mavrodi, lured participants with promises of 3,000% annual returns. He spent a whopping 330 million rubles to market it aggressively. This scheme collapsed, thereby leaving contributors shocked—and authorities apprehended Mavrodi, but interestingly, only for tax evasion and not the scam itself.

Charles Ponzi

Charles Ponzi, an Italian-born con artist, told people, “Give me money, and I’ll make you rich—fast.” Everyone was excited; however, instead of paying them, he pocketed $20 million. The whole thing blows up, and Ponzi ends up in prison multiple times. That’s how the original Ponzi scheme started.

Lou Pearlman

Investors trusted Lou Pearlman, a well-known figure in the pop music industry. Little did they know that he was running a $300 million fraud using fake financial statements. Eventually, the scheme fell apart, and Pearlman passed away in prison in 2016, leaving behind a strange mix of fame and scandal.

Barry Minkow

Barry Minkow, the teenage business prodigy, pulled off a $100 million Ponzi scheme by faking carpet-cleaning contracts. He fooled contributors while still in high school. Later, he even became a fraud investigator—before getting back into trouble. His first scam landed him five years in prison, thereby proving fraud isn’t just for adults.

Philip Barry – Leverage Group

$40 million gone! Philip Barry, a longtime investment manager, deceived investors with fraudulent investments and promises of steady returns. The wild part? His scheme lasted nearly 30 years. Eventually, authorities caught up, and Barry received a 20-year prison sentence, making it the scam that truly stood the test of time.

CBEX Trading Platform (Nigeria)

CBEX Trading Platform, a Nigerian cryptocurrency exchange, disappeared, carrying over $827 million in 2025. They promised a mind-blowing 100% return in just 30 days—classic red flag! Many first-time crypto contributors were caught off guard, and the crash set social media ablaze with memes, outrage, and endless “I told you so” comments.