The most legendary scams didn’t hide in the shadows—they operated in plain sight. Some fooled investors, others tricked entire industries. What makes them unforgettable is how deeply they rattled trust. Curious how millions got swept up in bold deception? These ten stories say it all.

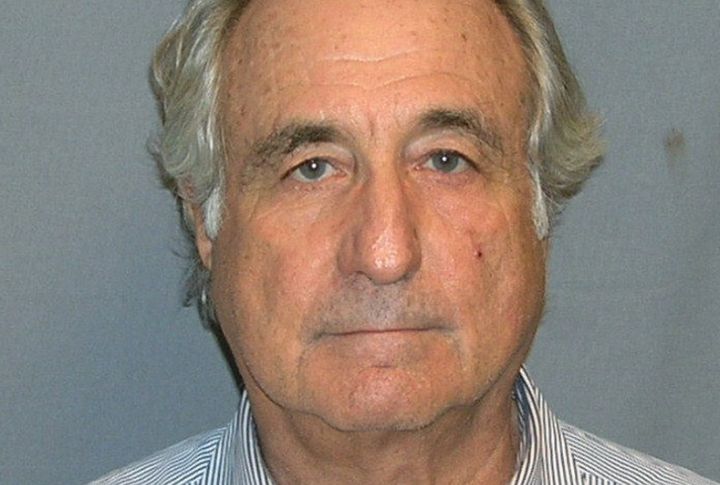

Bernie Madoff’s $65 Billion Ponzi Scheme

Consistent returns may feel safe, but red flags matter. Bernie Madoff defrauded investors of $65 billion through fake statements and zero actual trades. The man even ran NASDAQ, which helped build trust. Victims believed they were profiting for decades. A 150-year sentence followed in 2009 for orchestrating history’s largest Ponzi scheme.

Elizabeth Holmes And The Theranos Blood Test Scam

Elizabeth Holmes founded Theranos on the promise of revolutionary blood testing using just a single drop. The technology failed to deliver, but the company still soared to a $9 billion valuation. Backed by a powerful board, it took years before the truth unraveled. Holmes was later sentenced to 11 years for fraud.

Enron’s $74 Billion Corporate Collapse

Success without integrity crumbles fast. Enron fooled investors by hiding debt and faking profits. Eventually, its $90 stock price dropped to cents, ultimately leading to a massive 2001 bankruptcy. The truth surfaced, thanks to whistleblower Sherron Watkins. Her internal memo exposed the fraud and led to major changes, where new laws now hold corporate leaders personally accountable.

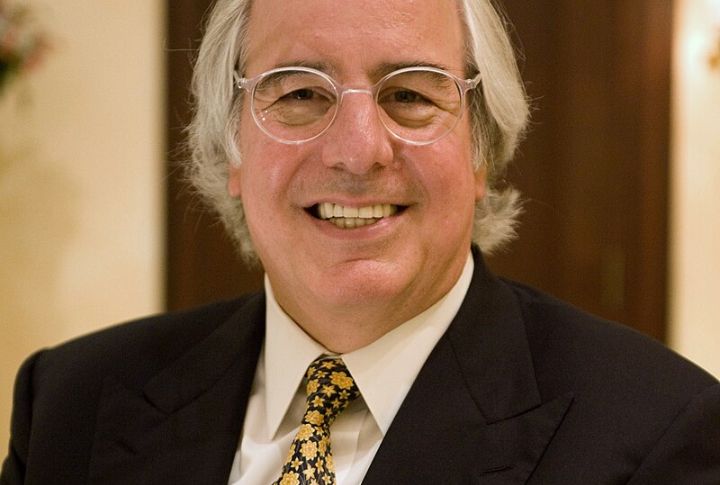

Frank Abagnale, The Master Of Disguises

Frank Abagnale began scamming at 16, impersonating professionals and forging checks. He posed as a Pan Am pilot, flying for free over 250 times. Abagnale also acted as a doctor and lawyer, cashing $2.5 million in fraudulent checks. After the FBI caught him, he eventually worked with them to stop fraud.

Wirecard’s $2 Billion Accounting Black Hole

A company once hailed as Germany’s PayPal collapsed under its own fiction. In 2020, Wirecard admitted $2 billion was missing. The money was claimed to be in Philippine bank accounts, but no bank could verify it. The CEO was jailed, the COO vanished, and a DAX 30 darling became one of Europe’s most shocking scandals.

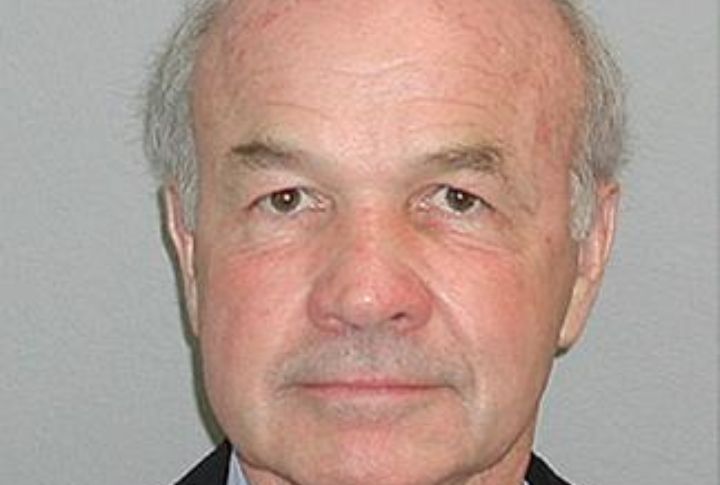

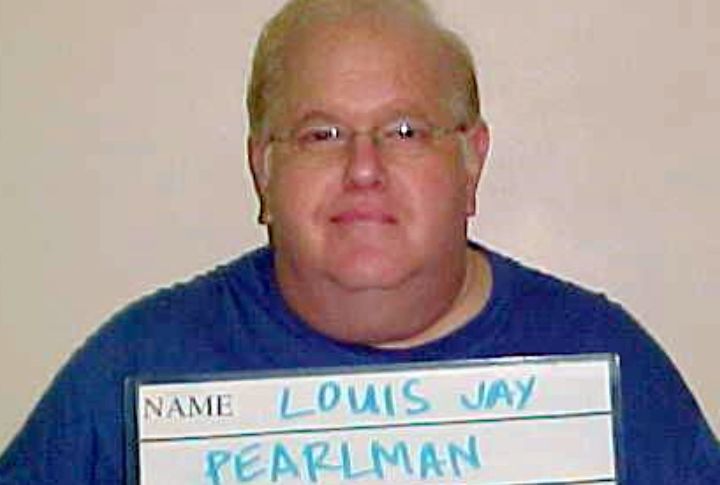

Lou Pearlman’s Boy Band Investment Scam

Lou Pearlman defrauded over 1,800 investors out of $300 million through Ponzi schemes and fake companies. His firms were also praised by auditors he had completely made up. Some investors were even given stock certificates for companies that didn’t exist. Despite managing NSYNC and the Backstreet Boys, he was sentenced to 25 years in 2008.

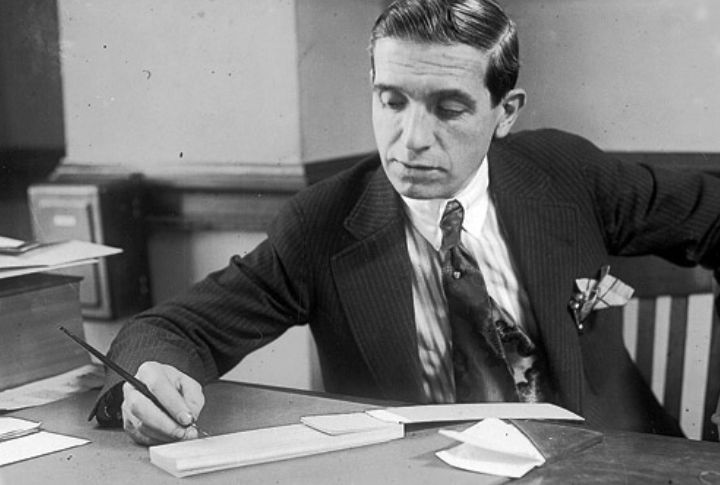

Charles Ponzi’s Original “Ponzi Scheme”

Doubling your money in 90 days? That’s what thousands believed back in 1920. The trick? New investors paid off the old ones. At one point, the scam pulled in $250,000 in a single day. More than $15 million vanished before anyone caught on. In fact, that’s how the term “Ponzi scheme” was born.

Fake Heiress Anna Sorokin (Aka Anna Delvey)

Pretending to be a wealthy German heiress, Sorokin scammed New York elites and hotels out of hundreds of thousands. Living lavishly while bouncing checks and conning friends, she even tried to secure a $22 million loan for a fake art club. Convicted in 2019 of theft and grand larceny, her story inspired Netflix’s “Inventing Anna.”

The $18 Million McDonald’s Monopoly Game Scam

For over a decade, Jerome Jacobson—head of security for the McDonald’s Monopoly promotion—quietly rigged the game by distributing rare winning pieces to a network of friends, including a former mobster. The FBI eventually exposed the $18 million scam through a sting operation nicknamed “Final Answer.” HBO later chronicled the case in “McMillon$.”

HealthSouth’s $1.4 Billion Accounting Fraud

At its peak, HealthSouth operated as the largest rehabilitation hospital chain in the United States. However, its executives inflated earnings by $1.4 billion to meet Wall Street targets. Insider cooperation with the FBI ultimately led to the exposure of the scheme. CEO Richard Scrushy was acquitted of fraud but later convicted in a bribery case.