As the retail landscape continues to evolve, 2024 has seen several major retailers closing stores, shutting down entirely, or gearing up for an online presence. Economic pressures, changing consumer habits, and the rise of e-commerce have forced these companies to reevaluate their strategies. These closures not only impact the economy but also affect the lives of employees and customers alike. Let’s look into the stories behind 14 significant retailers scaling back or ceasing operations this year in order to understand the broader implications of these changes.

Dollar Tree and Family Dollar

Dollar Tree, which owns Family Dollar, is closing 600 Family Dollar stores in the first half of 2024, with an additional 370 set to close upon lease expiration. The closures are attributed to years of mismanagement, poor store conditions, and competition from other discount retailers like Dollar General and Walmart. Inflation has further impacted Family Dollar’s customer base and profits.

Rite Aid

This drug store chain is closing many locations due to financial difficulties exacerbated by the COVID-19 pandemic and fierce competition from larger chains like CVS and Walgreens. The rise of mail-order pharmacies and online health services has further reduced foot traffic in physical stores. The closures particularly affect rural areas where Rite Aid often serves as a primary pharmacy, impacting those communities’ access to healthcare and jobs.

Macy’s

The retailer plans to shut down approximately 150 “underproductive” U.S. stores through 2026, including 50 locations in 2024. The decline in traditional mall traffic and a significant shift towards online shopping has severely impacted its sales. Macy’s has tried to adapt by enhancing its digital presence, but the cost savings from closing on-site stores are crucial to its survival strategy.

Neiman Marcus

Neiman Marcus is closing some of its Last Call outlet stores to focus on its core luxury business following bankruptcy restructuring. The decision is driven by the need to streamline operations and enhance profitability.

Walmart

The supermarket giant has shuttered six stores so far this year, with closures affecting locations in California, Maryland, Ohio, and San Diego. The company aims to shut down underperforming locations that do not meet their financial expectations, citing historical and current financial performance as a key factor.

Best Buy

Best Buy, the well-known electronics retailer, plans to close 10 to 15 stores by 2025. This decision follows the closure of 24 stores in the previous fiscal year. The company is shifting its focus to enhance the customer experience by transitioning from larger stores to smaller, more vibrant layouts in markets where it currently lacks a physical presence.

Victoria’s Secret

Victoria’s Secret is closing 50 stores in 2024 as it struggles with declining sales and an evolving market that favors more inclusive and comfortable lingerie brands. The company has faced backlash over its branding and marketing strategies, leading to a notable drop in customer loyalty. These closures are part of a broader effort to rebrand and restructure the company, impacting employees and reducing the presence of its iconic stores in malls.

Outdoor Voices

The athleisure clothing chain closed all its stores over a weekend in March 2024 and transitioned back to an exclusively DTC online business model. The brand initially expanded its distribution by taking its products offline to acquire new customers through stores in major U.S. cities.

Gap

The fashion brand is closing multiple Gap and Banana Republic stores as part of a strategic shift to reduce its real estate footprint and enhance its online presence. The company has struggled with declining sales and changing consumer preferences. This decision impacts employees and the shopping options available in many malls and shopping centers, as Gap has been a staple for decades.

Kmart

Kmart has faced relentless competition from more agile and innovative retailers like Walmart, Target, and Amazon. These competitors have outpaced Kmart in terms of pricing, variety, and convenience. Sears Holdings, which owns Kmart, has attempted various strategies to revive the brand, including closing underperforming stores, selling real estate, and focusing on more profitable locations. However, these efforts have largely been insufficient to counter the broader retail industry trends.

Pier 1 Imports

In recent years, consumers have become increasingly accustomed to shopping online. Pier 1 struggled to adapt to this shift, investing heavily in physical stores rather than developing a notable online presence. Moreover, financial mismanagement contributed significantly to Pier 1’s downfall. The brand struggled with high levels of debt, and its attempts to restructure and streamline operations were too late. The pandemic was a final blow for a company already struggling with declining in-store sales. In response to these challenges, Pier 1 decided to close all its physical locations and focus exclusively on its online business.

Party City

As the COVID-19 pandemic reached its peak, lockdowns and social distancing measures drastically reduced the number of large in-person gatherings such as birthday parties, weddings, and other social events. Even as restrictions have eased, many people have adopted new ways of celebrating, including smaller, more intimate gatherings and virtual parties. This shift has reduced the overall demand for large quantities of party supplies traditionally sold by Party City. Due to this, over 30 stores across the United States in 2024.

Forever 21

Forever 21’s business model, which relied heavily on the rapid production of cheap, trendy apparel, faced criticism for its labor and environmental policies. The brand has continued to close stores this month, including the one at Westfield shopping center, and three Forever 21 stores in Kansas City, Kansas, are also closing down. The once-popular fast fashion retailer has faced numerous challenges, including intense competition from online-only brands like ASOS and Fashion Nova, which offer similar trendy clothing but with a stronger online presence and often more sustainable practices.

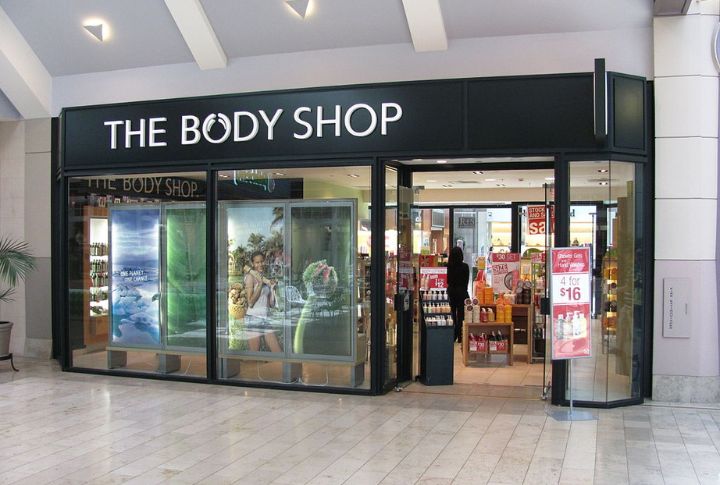

The Body Shop

This British beauty and cosmetics chain has shut down its operation in the U.S. and has already closed its website to new online orders. The company’s financial struggles were so significant that its U.S. arm was told it would not receive any funding to continue operations or conduct an orderly wind-down.

Comments

Loading…