The smallest tweaks in how you live day to day can quietly boost your savings without making life feel restricted. No fancy apps. No budgeting boot camps. Just a few practical shifts that actually stick. Over time, these little changes can mean fewer surprises in your bank account and more confidence in how you manage everyday money stuff—without feeling like you’re giving anything up.

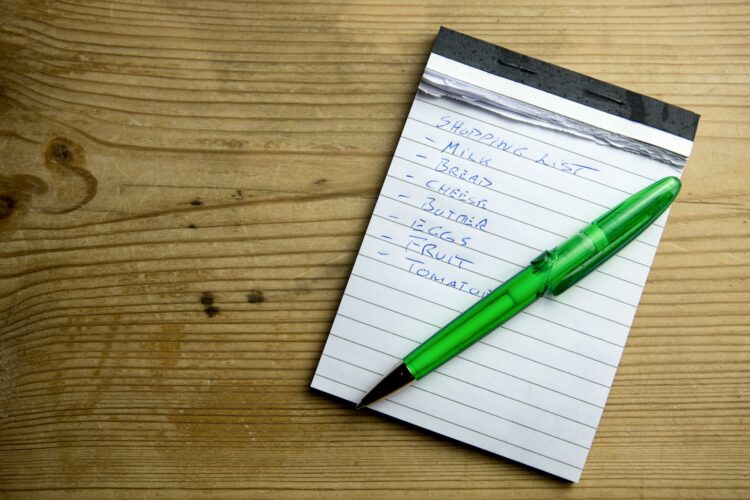

Make a shopping list.

Every extra snack or “might as well” item at the store adds up fast. If you head out with a short, specific list—and actually follow it—you’ll skip the wandering, the impulse buys, and the end-of-aisle traps. Most people shop more with their eyes than their plans, and stores are designed to tempt you. A list cuts through all that. It’s basic, but it’s one of the most effective habits you can build.

Use only one streaming service.

Most people cycle through the same handful of shows. So instead of paying for four or five services “just in case,” try rotating. Use one for a month, then cancel and switch. You still get fresh content, but without watching your bank account bleed through auto-renewals. Subscriptions are sneaky because they feel cheap individually—but together, they quietly eat up your budget. One at a time works just fine.

Withdraw weekly cash.

Decide how much you want to spend for the week, take that out in cash, and leave your card at home. It feels old-school, but watching your cash get thinner makes you more careful without even thinking about it. Swiping a card feels disconnected. Cash feels real. Once it’s gone, it’s gone—and that’s the point. It builds discipline without needing a spreadsheet or budgeting app.

Eat what’s already in your kitchen.

Check your fridge and pantry before you shop. There’s often enough food to make a few meals if you use what’s left. Cook the stuff that’s close to going bad. Mix dry items with whatever else you’ve got. It helps you waste less and spend less. You don’t need a fancy plan—just work with what’s already there. That food cost you money, so make sure it actually gets eaten.

Unsubscribe from store emails.

Those 20%-off emails aren’t doing you any favors. In fact, they’re designed to get you to spend on things you weren’t even thinking about. Start unsubscribing. Clear them out. The less you see those “flash sale” and “just for you” subject lines, the easier it becomes to shop only when you actually need something. Removing the temptation is easier than resisting it every single day.

Plan outings ahead of time.

Spontaneous plans are great—until you realize you spent triple what you normally would. Planning even a little bit ahead makes a difference. Know where you’re going, how you’re getting there, and set a rough budget. Last-minute dinners, Ubers, and event tickets add up. When things are planned, you’re more likely to stick to choices that don’t surprise you with a next-day money hangover.

Delete shopping apps.

The faster you can buy something, the more likely you are to spend without thinking. That’s why retailers love their apps. Delete them. If you really need something, you’ll take the extra step to find it. But for everything else, the extra friction helps you stop before hitting “buy now.” Less access means fewer impulse purchases. It’s a small digital detox with a very real payoff.

Set automatic savings.

Send a small bit of money to savings as soon as you get paid. Pick a number that doesn’t stress your budget and make it happen every time. You won’t notice it’s gone, and after a few months, you’ll have something solid sitting there. No tracking apps, no effort. It works because you’re not relying on memory or willpower—it’s already done.

Wait 48 hours before buying.

If something catches your eye, don’t buy it right away. Give it two days. Most of the time, the excitement fades. You might forget about it altogether. If it still feels worth it after that, fine—but rushing leads to way more regret. This trick works especially well for online purchases where everything is designed to make you click fast. Slow it down. A pause saves money.

Rewear and restyle clothes.

Look through your closet before buying anything new. That shirt from last week? Wear it again with something different. Try a new combo, layer it, or switch shoes. Most people won’t notice—and even if they do, it doesn’t matter. You don’t need a new outfit for every plan. Using what you have in new ways saves money without cutting your style. Keep it simple and repeat outfits; your wallet will thank you.

Cut delivery to once a week.

Choose one night a week for takeout and stick to it. Let that be your treat. On other days, make meals at home with what you already have. They don’t need to be fancy—just easy and filling. Ordering food too often costs more than you think. Keeping it to once a week helps you enjoy it more. Save that takeout for when it really feels worth it.

Batch your errands.

Skip the extra trips and shop once a week. The more often you’re out, the more chances you have to spend on things you didn’t plan for. Even small stops lead to snacks, drinks, or something “on sale.” Keep it simple—get what you need in one go. Stick to the list, head home, and avoid the slow leak of spending that happens every time you step into a store.

Ignore sales if you weren’t already buying.

Sales can trick you. Just because something’s 40% off doesn’t mean it’s a smart buy. If you didn’t plan to get it, that discount doesn’t help—it pushes you into spending you wouldn’t have done otherwise. So, walk away unless you already had the item in mind. A cheaper price doesn’t mean it belongs in your cart. Spending less still isn’t saving if it wasn’t needed.

Buy refills instead of new bottles.

From soap to spray cleaners, buying refill packs instead of new containers costs less and creates less waste. You probably already have the bottle—it just needs a top-up. Over time, the price difference adds up more than you’d expect. Check the price per ounce. Refill pouches are almost always cheaper, and they take up less space. It’s a small shift that quietly cuts costs without changing anything big.

Say no more often.

Not every invite, request, or expense needs a yes. Sometimes, the most powerful financial move is just politely turning something down. A dinner that’s out of your budget, a group gift that wasn’t planned, or an expensive trip. Learning to say no without guilt keeps your bank balance in check. It’s not selfish—it’s smart. You can still support others without putting yourself in a tight spot.