You probably wouldn’t think a kid’s toy could lead to your personal info getting stolen, but it happens more often than you’d imagine. And that trash can sitting outside your house? It might be a jackpot for an identity thief lurking around at night. A lot of everyday things can lead to identity theft, but they often fly under the radar because we don’t pay attention. Here are 15 everyday actions that could lead to identity theft.

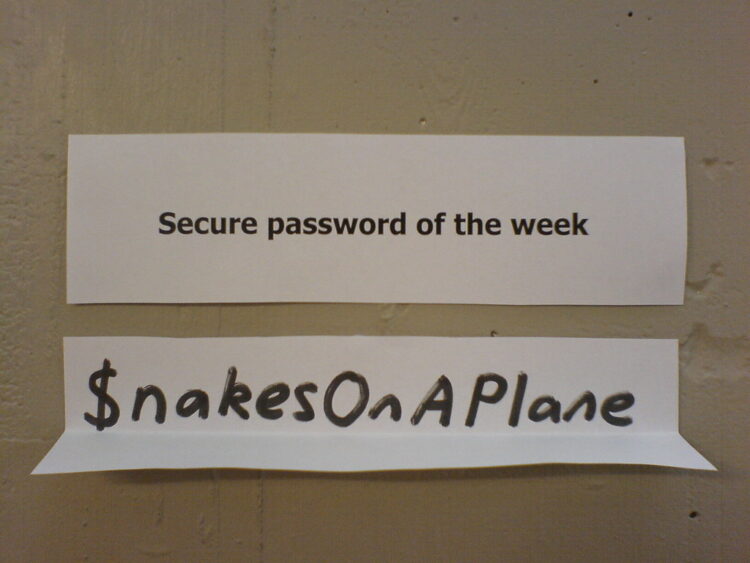

Using Weak Passwords

A password like “password123” might be very easy for you to remember, but it’s also easy for hackers to guess. Cybercriminals use automated tools that can crack simple passwords in seconds. According to data, 81% of hacking-related breaches stem from weak passwords. The best practice? Use a combination of letters, numbers, and some special characters, or go for a password manager to create strong passwords for you.

Oversharing on Social Media

Ever shared a “Throwback Thursday” post with your birth year? Or your pet’s name? These little details give hackers some super valuable information to piece together your identity. So, be careful with what you post, and try to keep personal details out of your feed.

Clicking on Suspicious Links

It only takes one wrong click to hand your personal information to identity thieves. Phishing scams are getting more sophisticated, often mimicking real companies to steal data. These scams are responsible for almost 36% of data breaches globally. Always verify the sender before clicking on any link, especially if the email or message seems out of the blue.

Using Public Wi-Fi for Transactions

Free Wi-Fi at your favorite coffee shop might save you some dollars down the road, but it’s not safe. Public Wi-Fi is often unsecured, so hackers try to intercept the information you send and receive. If you want to stay safe, don’t access sensitive public accounts or use a virtual private network (VPN).

Not Shredding Personal Documents

Throwing away old bank statements, credit card offers, or utility bills without shredding them might seem harmless, but it’s an open invitation for “dumpster divers.” These thieves search through trash to find any valuable information they can use. A shredder is a small investment that can protect your identity.

Auto-Saving Credit Card Information Online

We know how tempting it is to click “save my card” for a quicker checkout next time but storing your credit card deets on websites leaves you vulnerable to hackers. In 2020, 86% of data breaches were financially motivated, and saved card details were a prime target. While it might take an extra minute to enter your payment info each time, it’s a small price to pay for security.

Not Monitoring Your Bank Statements

Life gets busy, and it’s very easy to forget to check your bank and credit card statements regularly. However, this habit can leave you unaware of fraudulent charges. Often, thieves make unnoticed purchases before going for larger amounts—catching these early can prevent further damage. Make it a routine to review your statements for any unfamiliar transactions.

Responding to Unfamiliar Calls or Emails

“Hello, I’m calling from ABC Bank. We need your account info.” Sound familiar? Scammers often impersonate banks, tech support, or government agencies to trick you into revealing sensitive information. In the U.S., phone scams led to almost $30 billion in losses in 2021 alone. Always be extra cautious and contact the company with a verified phone number if in doubt.

Reusing the Same Passwords

Reusing passwords might save you the trouble of remembering different ones, but if a hacker gets hold of one—they could potentially access all your accounts. Research reveals that 61% of people reuse passwords across multiple sites, and that’s how they become vulnerable to a widespread breach. You can simply dodge getting robbed by using unique passwords.

Storing Passwords in Your Browser

Browsers like Chrome or Firefox offer to store your passwords for you, but this convenience comes with a big risk. If your computer gets infected with malware or hacked, stored passwords can be easily accessed. Instead, opt for a secure, dedicated password manager, which encrypts your login credentials, making them much harder to steal.

Neglecting Software Updates

Those software update notifications may be super annoying—but skipping them could put you at risk. Updates include patches for security vulnerabilities that hackers exploit. According to a report, 60% of breaches involved vulnerabilities that could have been fixed with a simple update. Regularly updating your software is a quick and easy way to protect yourself from threats.

Sharing Personal Info Over the Phone

We’ve all been asked to provide sensitive details like Social Security numbers or card details over the phone, but it’s super important to know who you’re talking to. Scammers are experts at posing as legitimate businesses, and once they have your information, they can easily commit identity fraud. Always verify the caller’s identity before sharing personal information, or totally refrain from giving such details.

Falling for Online Shopping Scams

Fake online stores or deals that seem too good can easily lead to your credit card info being stolen. Before you buy from a site you don’t know, take a minute to do some research. Check out reviews, make sure the payment methods are secure, and look for that padlock icon in the browser bar to confirm the site’s legit.

Using Old Security Questions

Remember those basic security questions like “What’s your mother’s maiden name?” Hackers can easily dig up the answers through your social media profile or public records. That’s why experts suggest using tougher or more personalized questions. Even better, turn on two-factor authentication (2FA) whenever you can. It gives you extra protection by sharing a code to your phone number or email before you can log in.

Forgetting to Log Out of Shared Devices

It’s easy to forget to log out after checking your email or bank account on a friend’s computer or a public one, like at the library. But if you stay logged in, the next person who uses that device could get right into your accounts. Make it a habit to log out after every session and avoid accessing sensitive accounts on shared or public devices. It’s a simple way to protect your info from getting stolen.