Property investments can offer substantial returns and financial growth. However, choosing the right location is of utmost importance to maximize these benefits. This is because certain states could undermine your investment due to factors like economic instability. Here are 15 states to avoid property investments in the near future.

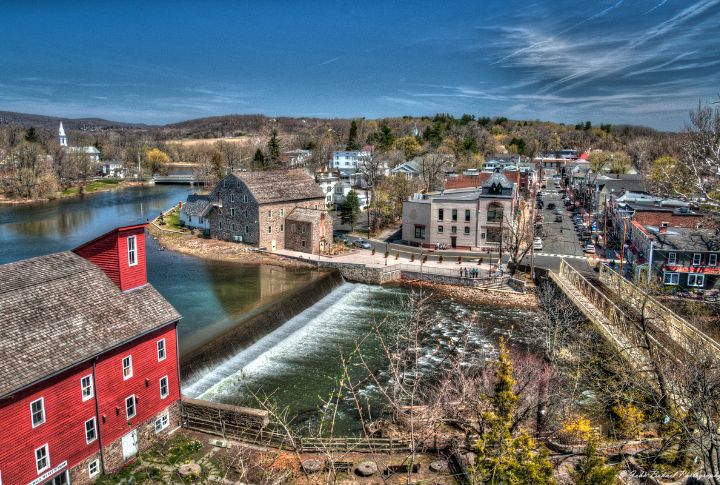

Pennsylvania

Pennsylvania’s property market can be tricky, particularly its aging infrastructure and high property taxes. Think before dealing with old homes needing costly repairs and steep taxes eating into your returns. If you’re unprepared for these challenges, Pennsylvania might not be the best place for you.

California

With skyrocketing real estate prices and a challenging housing market, California presents significant barriers for potential buyers. High property costs are often coupled with exorbitant property taxes and a volatile market that can lead to unpredictable investment returns. Moreover, persistent drought conditions and frequent wildfires pose long-term risks.

New York

The real estate landscape in New York is marked by steep property taxes and maintenance costs that can strain even well-capitalized buyers. Additionally, New York City’s rental market has faced fluctuations and uncertainties. Economic disparities and a high cost of living further complicate the decision to invest in the state.

Nevada

As you consider purchasing property in Nevada, be sure to factor in the state’s volatile real estate market, heavily influenced by fluctuating tourism and gaming industries. Property values can swing significantly due to economic shifts, the impacts of climate change, and increasing wildfire risks, making long-term investments more uncertain.

New Jersey

High property taxes significantly erode the value of investments, making New Jersey a less appealing choice for prospective buyers. The state also grapples with an aging infrastructure and frequent natural disasters, leading to increased maintenance costs and insurance premiums. All these are combined with a relatively sluggish job market.

Illinois

Illinois’ economic instability and substantial state debt create a precarious environment for real estate investments. Chicago, in particular, faces declining property values and an oversupply of housing, which adversely affect potential returns. High property taxes and deteriorating infrastructure can also detract from the state’s attractiveness.

Texas

Despite its booming economy and population growth, Texas’s real estate market faces concerns over climate-related risks, like hurricanes and extreme heat. The state’s rapid expansion often leads to infrastructure strain and potential overdevelopment. Therefore, it is vital to consider long-term sustainability and possible market volatility before investing.

Florida

While the sunny allure of Florida is undeniable, the state is increasingly burdened by severe weather events like hurricanes. These extremities can lead to skyrocketing insurance premiums and property damage. The threat of climate change is also very real here, with rising sea levels threatening coastal areas.

Ohio

Ohio’s property market faces significant challenges due to economic stagnation in certain areas. Job growth has been slow-moving, and some cities are struggling with population decline. Imagine investing in a property where the local economy isn’t thriving—your investment might not appreciate as much as you’d hope.

Michigan

The property market in Michigan has its own set of pitfalls, especially in areas struggling with high unemployment rates. Avoid properties in cities still grappling with the fallout from the automotive industry’s ups and downs, as you might end up with a property that’s difficult to sell or rent.

Maryland

High property taxes and a higher-than-average cost of living affect Maryland’s real estate market. There’s the added stress of managing a property where your expenses are consistently high, potentially eroding your investment expectations. The state’s property market can also be highly competitive and volatile.

Louisiana

Louisiana’s property market is affected by severe weather events, including hurricanes and flooding. These natural disasters can lead to frequent and costly damage, which raises the risk of higher insurance premiums and repair costs. Additionally, the state has faced issues with property devaluation and inconsistent local governance.

Georgia

Although Georgia offers appealing real estate opportunities, potential buyers should be cautious of the growing urban sprawl and traffic congestion in metropolitan areas like Atlanta. This rapid expansion can strain infrastructure and increase living costs. Moreover, due to inconsistent property tax policies, investing in Georgia could present unforeseen complications.

Connecticut

Investing in Connecticut might initially seem attractive, but high property taxes and a declining population can pose significant drawbacks. A high cost of living, a sluggish job market, and slow economic growth can lead to higher carrying costs. Additionally, Connecticut’s aging infrastructure can add to the financial burden.

Massachusetts

Massachusetts’s notoriously high property prices and rigorous regulatory environment present a complex real estate landscape. The state’s significant property taxes can diminish whatever gains you hoped to enjoy. Also, the challenging climate, with its harsh winters and frequent snowstorms, can lead to costly maintenance and repair issues.